- #Square invoice fees for free

- #Square invoice fees upgrade

- #Square invoice fees plus

- #Square invoice fees professional

This site does not include all companies or products available within the market.

The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

#Square invoice fees for free

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. Zoho’s invoicing platform offers these features as part of their free version.

#Square invoice fees plus

For comparison, FreshBooks charges a $15 monthly fee for the Lite subscription and $25 for their Plus subscription. When compared with other invoice platforms that charge a subscription fee, $20 per month is on the higher end.

#Square invoice fees upgrade

While Square does offer more customization options, these features require an upgrade to Square Invoices Plus, which costs $20 per month. For this reason, Square Invoices is better suited for business owners who are already using Square for their business, whether it be to process credit card payments for online or in-person services. However, there are fewer design features available. Square does offer customization options mentioned in the previous section.

#Square invoice fees professional

There are several great free invoice platforms out there, and it makes sense to do some research about which one best suits your company, as they vary slightly and are best suited for different business structures.īoth PayPal and Zoho have excellent customization options for invoices such as, in Zoho’s case, the ability to brand your invoice and tailor it for different clients and choose between different templates, which can give your invoice, and by extension your company, a more professional look. Phone and email support, live chat, knowledge base and help center

Live chat, video tutorials, phone and email support Phone and email support, knowledge base and live chat

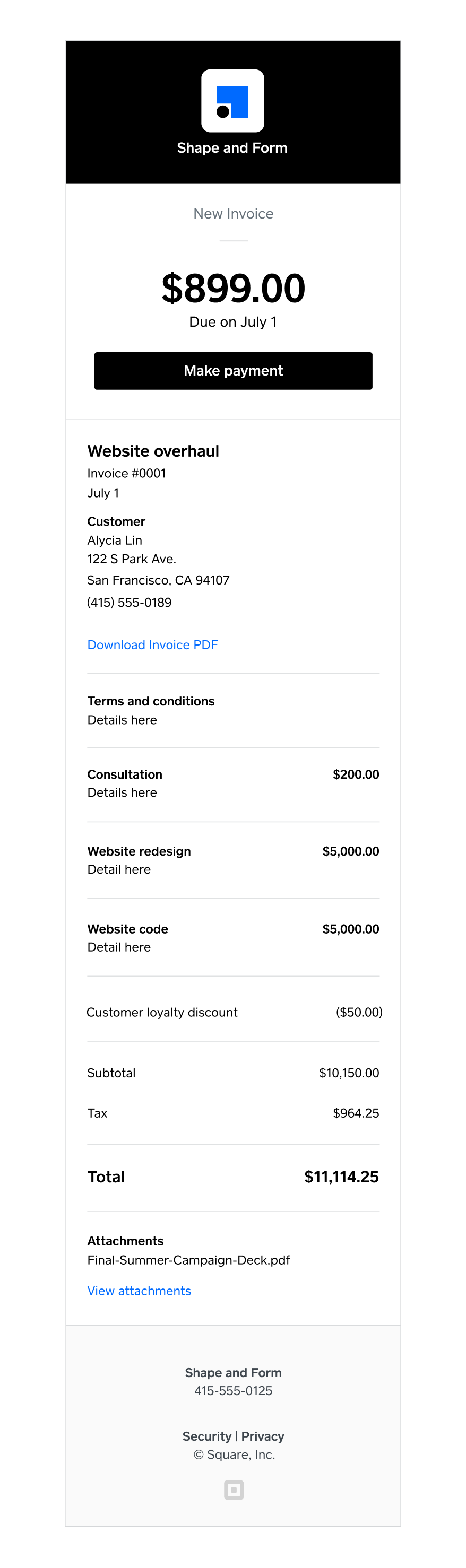

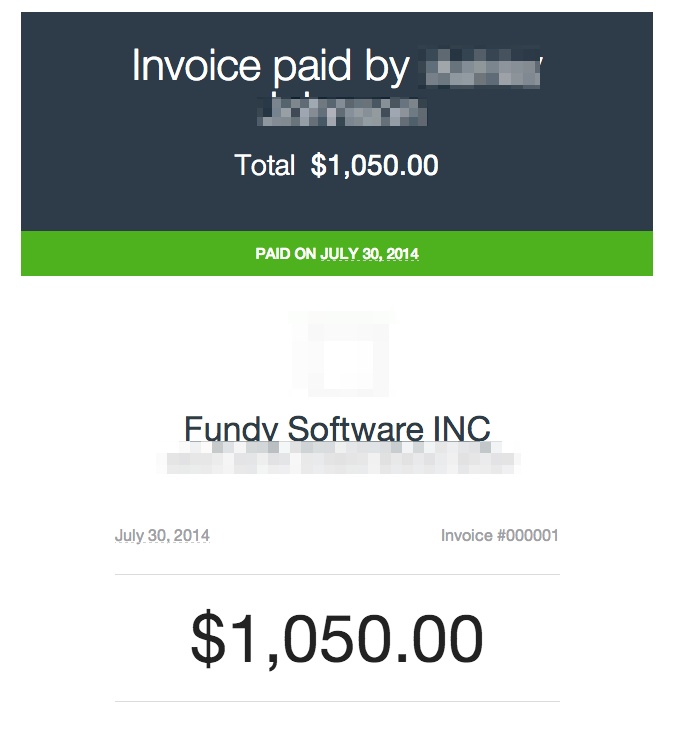

Yes - By credit card, Apple Pay, Google Pay or ACHįees vary - Integrates with third-party payment processors Unlimited - Including multi-package estimates Square Invoices can process credit or debit card payments (for a 2.9% plus $0.30 per transaction fee), ACH bank transfer (for a 1% fee) or a gift card that a customer has bought from you (for the same fees as credit and debit cards). Square also enables the ability for account holders to hold customers’ credit card information on file and charge the card automatically.Īccount holders can choose the payment forms they will accept, or give customers the option to choose. You can also choose for the invoice to be sent at a future date and customize when each invoice is due (in seven days, in 14 days, etc.). If you are sending a recurring invoice, you can either repeat it every day, week, month or year. You can also adjust when payment is due.Īdditionally, you have the option of either sending a one-time invoice or a recurring invoice. You can either choose to send it immediately or at a later date. You’ll select the customer you want the invoice sent to, and enter a few basic pieces of information: invoice title, invoice ID, message, date of service and the date you want to send this invoice. Square Invoices allows you to create an invoice with a click of a button. But Square offers business owners a lot more accounting features to run and organize their business. Square is best known as a payment processor for in-person transactions. Square Invoices is a free tool that allows you to send invoices to clients and receive payments.

0 kommentar(er)

0 kommentar(er)